What UK company classification changes mean for your business

09 July 2025

- Contact Adam Wildbore

- Senior Audit Director

- [email protected]

- +44 75 9702 0702

Audit and financial reporting threshold changes came into effect from 6 April 2025 and may impact your business.

Limited Companies and Limited Liability Partnerships (LLPs) operating in the UK may encounter changes to their financial reporting obligations in the coming 12 months which could lead to an exemption from statutory UK audit.

The recent threshold changes account for inflation and aim to make the UK regulatory landscape more competitive.

ZEDRA’s Adam Wildbore or Edward Wallis share their thoughts on the implications and considerations for UK companies and international groups, and highlight the benefits of voluntary audits regardless of classification.

Company classification for financial reporting

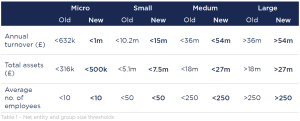

Under The Companies Act 2006, all UK companies are classified as either Micro, Small, Medium or Large. A company’s categorisation then determines the financial reporting obligations and audit requirements for the company.

Although employee thresholds remain unchanged, updates to turnover and balance sheet criteria mean that some UK companies may now benefit from reduced compliance obligations, as shown below:

Many companies and LLPs will now be able to take advantage of FRS 102 for small entities and apply the provisions under Section 1A for reduced reporting. If the company or LLP continues to meet the thresholds as medium or large, it’s worth reviewing whether there are additional disclosure exemptions via the ‘Reduced Disclosure Framework’ if part of a larger group.

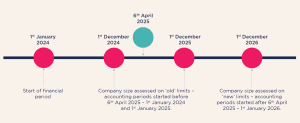

These changes are effective for accounting periods beginning on or after 6 April 2025. The timeline below illustrates how these changes apply to companies with a 31 December year end:

A company would qualify as ‘small’ if it meets the new limits at 31 December 2026, and at 31 December 2025 as the new limits are applied retrospectively. A company would qualify as small at 31 Dec 2025 if the thresholds were not breached at 31 Dec 2024.

Group implications

Companies that are part of a group still need to assess their size against the thresholds based on the group as a whole – so taking into consideration group turnover (less any intercompany trade), group gross assets (after elimination of intercompany balances) and group employees.

The group may still be eligible for audit exemption if certain criteria are met.

Benefits of an audit

Even if a company is small and can take exemption from UK statutory audit, the company can still opt for a voluntary audit. There are many benefits of being audited:

- Provides credibility – an audit is widely recognised as beneficial when companies are looking to exit or raise finance, providing added value to stakeholders in your business.

- Shareholder confidence – an independent external audit can provide shareholders with confidence their investment is being run well and transactions and balances are being scrutinised through audit procedures. This is particularly helpful where some shareholders are removed from day to day operations.

- Identify weaknesses in systems and controls – an audit can identify areas of weakness in systems and controls. The auditor will then present any deficiencies for management to take preventative action.

- Highlight risks – an audit can identify areas of commercial risk or concern. For example overdependence on suppliers or customers, employment issues, missing liabilities or the company is looking at profitability of contracts in an incorrect way.

- Assist in commercial decisions – understanding your numbers – and having these verified by an independent team – can help you manage your business more effectively and make better-informed decisions.

- Accountability – if your business has multiple divisions, directors, or product lines, an audit can help in holding these areas and people accountable. While it is not the role of an auditor to identify fraud, audits can help identify certain fraud risk factors, and act as a deterrent.

How ZEDRA can help

Our team of corporate and global expansion experts in the UK have considerable experience in providing audit, assurance and advisory services across a diverse portfolio of UK companies and multinational businesses.

To find out more about these recent changes or for advice on corporate compliance in the UK and beyond, contact Adam Wildbore or Edward Wallis.

What UK company classification changes mean for your business

You can view our guide here.